The G-20 has pushed the Financial Stability Board (FSB) into action on bank reform – the policy paper from the FSB on global systemically important institutions (G-sifis) had a list of 29 G-sifis that will now spend much energy trying to bend the Basel rules as they apply to each of them. Then there’s Basel III, for what it’s worth. But it hasn’t made much progress on other items on its agenda, such as the so-called ‘framework for growth’ and global imbalances. As the leading international forum, the G-20 should be the body that looks at issues such as the eurozone crisis, though the euro area governments showed an absurd reluctance to allow eurozone issues to be discussed. It was not until Tim Geithner, the US Treasury Secretary, and George Osborne, the UK chancellor of the exchequer, made it clear such a dog-in-the-manger stance was unacceptable, that euro area governments accepted that the rest of the G-20 had to play its part in their dealings with the eurozone crisis, and that open discussion was vital for this.

At Cannes there was some progress on peripheral issues. However, from the perspective of emerging markets, the big picture was of little readiness to change. The international monetary system and its governing bodies were dominated by reserve centres – the US, euro area, UK and Japan – which had highly indebted, highly leveraged, dysfunctional and downright dangerous banking and financial systems. Why weren’t the dangers posed to the world from these faults discussed?

But the talks on a wider reform of the system have got nowhere. At the early meetings of the G-20, emerging-market countries wanted to discuss ways to protect themselves from the effects of the inflows of ‘hot money’ they were experiencing for most of 2010–11 as a result of ultra-low interest rates and the permissive monetary policies followed by the Federal Reserve. Although these have been partially reversed during 2011, the emerging markets remained highly critical of the policies of credit and quantitative easing, seeing it as little more than a means of depreciating the dollar. Reserve managers in emerging markets worried that this US policy would destabilise the dollar-denominated assets that formed the base of the pyramid of reserve assets. The US administration said that discussion of US monetary policy was out of order; its political interest was in piling up pressure on China and other emerging markets to cut their current account surpluses, which the US saw as a function of undervalued exchange rates. But China was willing to share control over its exchange rate policy only on condition that the US was willing, in effect, to share control of its monetary policy: neither condition was acceptable to the other.

These divisions also reflected the absence of a broadly accepted analysis linking faults in the working of the international monetary system with the financial crisis. The official view of most developed countries was indeed that the system had responded well to a crisis caused – on this view – mainly by faults in financial regulation and China’s currency policy, and that it was to these areas that attention should be directed in the effort to prevent a return of the crisis – hence the emphasis on Basel III and China bashing.

Thus officials of developed countries pointed to progress made in strengthening bank capital and liquidity buffers, financial reform legislation in the US and UK, and the new macroprudential toolkit being bolted onto the existing responsibilities of central banks and other agencies. Central bankers had always essentially blamed financial regulators and lax bank management for the crisis. Their own monetary policy frameworks – versions of explicit or implicit inflation targeting with flexible exchange rates – had, they felt, performed well. On this reading, governments were justified in limiting G-20 discussions of the international monetary system itself to a number of specific issues that needed attention.

Yet the failure to reach agreement even on limited and specific issues did nothing to strengthen confidence that in the next crisis – which could be just around the corner – governments would be able to agree on a united response. Given public displays of disunity, and with a protectionist mood rising in the US, confidence in the capacity of governments to effectively address a renewed crisis was low. Yet, at the same time, it seemed likely that talks on a radical reshaping of the system would only get going in earnest if the global economic outlook darkened further. The global economy has obliged by turning sharply downwards.

Will this and little Greece concentrate minds? There were some hopeful signs. Leaders of emerging markets were well aware that they could not retreat to former policy models of state planning and controls. From Moscow to Brasilia, all remained aware of the need to avoid a relapse into protectionism that had accompanied the currency and diplomatic conflicts of the 1930s with such far-reaching and tragic geo-political consequences. Talk of ‘currency wars’ was seen as the most prominent expression of the threat of protectionism. They also knew they had great difficulties in coordinating policy views among themselves. The way in which the International Monetary Fund’s (IMF) managing director, Christine Lagarde, was selected highlighted their weakness in finding common ground.

What was needed was for the big three – US, euro area (France and Germany) and China to forge a united front on the need for a longer-term reform of the system. They should show the statesmanship, leadership and vision to fend off short-term domestic political pressures and strive to form a joint view about systemic reform – and order officials and the IMF to get on with drawing up a strategy. A coherent view of where the international system as a whole should be heading in the long term would serve to put the internal problems of each centre and currency area into a broader collaborative context.

In this issue, Central Banking makes a further contribution to this debate, with articles by Warren Coats on the case for a ‘real SDR’, Kevin Dowd on the case for a ‘new’ gold standard, and Ousmène Mandeng on the need to integrate the currencies of emerging markets into the international monetary system....

Robert Pringle

Monopoly Capitalism is UN-Constitutional and must be opposed.....

Top economists and financial experts agree that our economy will never recover unless Wall Street fraud is prosecuted.

But the government has more or less made it official policy not to prosecute fraud, and instead to do everything necessary to cover up for Wall Street.

Indeed, Business Insider writes today:

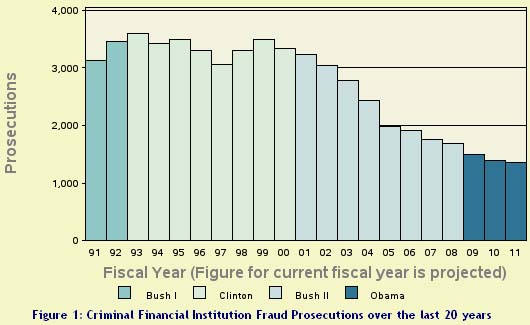

A new study out from Syracuse University shows that the number of federal prosecutions for fraud at financial institutions has been steadily decreasing since 1999. [via ThinkProgress]

This is particularly interesting given that in the wake of the 2008 financial crisis, public sentiment towards banks and other financial firms have been generally negative and prone to suspicion.

Alexander Eichler at the Huffington Post points out:

The falling number of fraud prosecutions is striking given what many claim is a strong pattern of financial-sector misconduct in recent years, culminating in a housing crisis characterized by alleged rampant mortgage fraud and improper foreclosure, as well as the weakening of the national and global economy.

Barry Ritholtz notes:

In such a target rich environment,. how on earth is it possible that Bank Fraud prosecutions are dropping? It is an outrage!

***

I bitched about this when George W. Bush was President, and I will continue until we get someone in the White House who understands what the RULE OF LAW actually means . . .

There were also many times more financial prosecutions under President Reagan than there are currently.

No wonder Occupy Wall Street is demanding:

Enforce the Laws for the 99%

No wonder top financial crime expert Bill Black says that we have to fire Eric “Place” Holder and all other government officials who are blocking prosecution of the criminals who caused the economic crisis....

It’s clear, Obama’s got to go, he’s nothing but a Despicable CIA front-man for Wall St. crooks like Geithner and Summers. The entire system is rotten to the core and needs to be gotten rid of....

The trend-lines clearly seems to have changed at a specific year, 2001. We all know what happened that year. So it seems reasonable to suppose that the focus of federal investigative agencies shifted from crimes like financial fraud to terrorism. Fortunately for crooked bankers, financial fraud is not as terrifying as terrorism. I don’t expect the public or politicians will care about the facts posed here while the media continues to sensationalize the Al-CIAda....Islamic extremist threat....

A culture of crooks: http://goo.gl/f4pXo

King George Twice As Popular During The Revolutionary War As Congress Is Today

The Washington Post provides this handy chart showing that Congress is less popular than Communism, BP during the Gulf oil spill or Nixon during Watergate:

Indeed, King George was approximately twice as popular among Americans during the Revolutionary War than Congress is today:

Historians have estimated that between 15 and 20 percent of the European-American population of the colonies were Loyalists....

Big Corporations Have More Free Speech than REAL People...

Robert Reich sums up the 1%’s hypocrisy towards the First Amendment:

A funny thing happened to the First Amendment on its way to the public forum. According to the Supreme Court, money is now speech and corporations are now people. But when real people without money assemble to express their dissatisfaction with the political consequences of this, they’re treated as public nuisances and evicted.

Of course, the Constitution is supposed to provide the right to free speech no matter what type of threat we’re supposedly under. That was the whole idea.

And the Founding Fathers hated big corporations. See this, this and this. They were as suspicious of big corporations as they were the monarchy. So they only allowed corporate charters for a very brief duration, in order to carry out a specific, time-limited project.

As James Madison noted:

There is an evil which ought to be guarded against in the indefinite accumulation of property from the capacity of holding it in perpetuity by…corporations. The power of all corporations ought to be limited in this respect. The growing wealth acquired by them never fails to be a source of abuses.

Indeed, while the Boston Tea Party was a revolt against taxation without representation, it largely centered on the British government’s crony capitalism – and disproportionate tax breaks – towards the East India Company, the giant company which dominated the tea market and hurt small American business.

Protesting against the government propping up today’s giant banks – who are ruining the chance for small businesses to have a fair chance at competing – is exactly the same idea.

Later presidents had a similar view. For example, Grover Cleveland said:

As we view the achievements of aggregated capital, we discover the existence of trusts, combinations, and monopolies, while the citizen is struggling far in the rear or is trampled to death beneath an iron heel. Corporations, which should be the carefully restrained creatures of the law and the servants of the people, are fast becoming the people’s masters.

And Teddy Roosevelt had to break up banking trusts which had taken over the country.

Adam Smith – the founder of free market capitalism – also railed against corporate monopolies.

And conservatives as well as liberals are war loudly warning against American corporations becoming overly powerful in relation to the people.

For example, last month:

The Oath-keepers announcement zeroes in on this issue in a way that both conservatives and liberals can agree on:

When a corporation becomes larger than is useful, and seeks to concentrate financial power into the political and governmental spheres, its likeness is no longer the King Snake, but instead is more like a Rattlesnake. At a point we call such corps “Monopoly Capitalists”. By the time a grouping of such Monopoly Capitalist corps are setting U.S. foreign policy, which the arms industry certainly does nowadays, the problem becomes unbearably apparent. Bechtel comes to mind, along with Halliburton, the Carlyle Group, Monsanto, General Electric, et al.

***

Monopoly Capitalism is UN-Constitutional and must be opposed.....

Supranational Globalization vs Nation State Sovereignty...

As the eurozone sovereign debt crisis unfolds, an unspoken political undercurrent is turning a complex yet narrow restructuring negotiation between sovereign government debtors and transnational bank creditors in a regional sovereign debt crisis into a broad political confrontation of supranational globalization versus nation state sovereignty in the economic ecosystem and financial infrastructure of the existent neoliberal economic world order.

On a more fundamental level, the global credit crisis of 2008 that began in the US, followed by the European sovereign debt crisis of 2011 as a collateral development of it, are raising questions on the viability of neoliberal market capitalism that had ascended to universal status as the economic/financial system of choice since the end of the Cold War. After the dissolution of the USSR, Europe worked to correct its division between capitalistic democracy and socialist central planning since the end of WWII. Led by a reunited Germany at the end of the Cold War, many influential Europeans began to work for the integration of Europe to form a single common market with a common currency in the form of the euro introduced in 1999.

The Flawed System of Globalized Low-Wage Market Capitalism

Europe, similar to other participants in globalized neoliberal trade, fell into the trap of a cross-border financial regime propelled by debt capitalism, the initial phase of which appeared to be a new wonder express train to easy prosperity through financial manipulation. Low wages achieved through cross-border wage arbitrage provided extraordinary returns on capital. Low-wage workers were allowed to keep consuming beyond their wage income by easy consumer credit to absorb the overcapacity from overinvestment funded by high return on capital. All went swimmingly until the debt bubble burst in mid 2007 in New York, the world capital of a new game called structured finance.

Structured finance involves the pooling of financial assets with long-term revue streams into a hierarchal structure of prioritized claims, known as tranches, of gradations of risk to issue structured securities for sale to investors of varying appetite for risk with compensatory returns. The unbundling of risk with structured securitization expanded the market for risk by allowing investors to selected tranches to fit their investment objectives and by wide redistribution of risk from particular investors to systemic market risk, under-pricing risk for any particular exposure, thus encouraging speculative investment. Structured finance can lead to increases in the aggregate value of a pool of financial assets by under-pricing unit risk through the shift of part of the risk to the global financial system.

With the emergence of cross-border wage arbitrage, and the globalization of finance, the US financial sector gained control of the US economy, transforming finance from a sector that served the industrial economy to a dominant position of a profit center, replaced industrial capitalism in which full employment is a necessary objective, with finance capitalism in which structural unemployment is a necessary objective to prevent inflation. Money can actually be made by management decision to lay off employees.

Increasingly, globalized market capitalism, with free trade and financial innovation as its partners in crime, is being exposed by unfolding events as the defective system that has produced unsustainable financial imbalances that resulted in recurring global crises of excessive debt and deficient demand. Monetarism as practiced by contemporary central banking has provided the theoretical anchor for growing dependence on debt as the necessary stimulant and facilitator of financial expansion, confusing unsustainable market expansion fueled by debt as economic growth that would produce sustainable prosperity.

Deregulated market capitalism operating with loose accommodating central bank monetary policies has produced extreme disparity of income and wealth in the name of necessary capital formation both among competitive trading nations and among competitive market participants within nations that have adopted market economy as the only path to economic growth. The flawed theories of monetarism rely on persistent structural unemployment (above 6%) as the prime effective way to maintain price stability unnatural and elusive in business cycles.

The excessive concentration of capital in a few hands has led to deregulated cross-border movement of predatory capital to maximize return by depressing workers’ wages world wide via cross-border wage arbitrage, generating investment gluts that produce industrial overcapacity out of balance with stagnant aggregate demand due to low wage levels in all trading economies. Neoliberal trade no longer operates according to Richardian comparative advantage, but is based on absolute advantage of capital over labor system wide.

Low wages provide excess profit to yield destabilizing high return on capital that eventually leads to over-investment to cause industrial overcapacity which cannot be absorbed by low-wage consumer demand. To complete the downward cycle of overblown financial market expansion that obstructs optimum economic growth because excessively high return on capital undercuts wages needed to support demand, central bank monetarism supplies massive liquidity to the financial market to fuel unsustainable consumer debt to mask the imbalance between high return on capital and low wage levels. This is the fundamental cause of the global debt crisis that imploded first in the US in mid 2007 and spread to the European sovereign debt crisis of 2011.

Please see my April 2010 series” GLOBAL POST-CRISIS ECONOMIC OUTLOOK:

Part XII: Financial Globalization and Recurring Financial Crises

Part XI: Comparing Eurozone Membership to Dollarization of Argentina

Part X: The Trillion Dollar Failure

Part IX: Effect of the Greek Crisis on German Domestic Politics

Part VIII: Greek Tragedy

Part VII: Global Sovereign Debt Crisis

Part VI: Public Debt and Other Issues

Part V: Public Debt, Fiscal Deficit and Sovereign Insolvency

Part IV: Fed’s Extraordinary Section 13(3) Programs

Part III: The Fed’s No-Exit Strategy

Part II: Two Different Banking Crises - 1929 and 2007

Part I: Crisis of Wealth Destruction.

Europe Integration Put at Risk by National Interest Calculations

Governments of sovereign nation states both inside and outside the eruozone are now quietly but observably formulating protectionist financial strategies to respond to adverse impacts on their interlinked yet still separate individual national economies, banking systems and financial infrastructure from an inevitable collapse of the global financial system detonated by the European sovereign debt crisis of 2011, which has been festering in Greece and threatens to spread to Portugal, Spain and Italy and beyond as the sovereign debt crisis spins rapidly out of control.

Behind the noble façade of the need and the willingness to sacrifice national interests for the common good lurks an economic realpolitik calculation in the deliberation taking place in high councils of sovereign governments. Individual governments are apprehensive about the ruinously high cost of being left as part of a dwindling group of eurozone supporting team players without ulterior motives. The task of bailing out heavily-indebted weak economies in the eurozone is turning out to be a bridge too far for the governments of the healthy, stronger economies. This is because domestic politics of the weaker economies makes it difficulty for political leaders to restore needed fiscal discipline to solve their sovereign debt problem to preserve the eurozone monetary union. The financial cost of regional solidarity may well be too high for all member states rich and poor alike. This high cost will cause serious socio-political instability across the entirely eurozone, the European Union and beyond.

France and Germany have championed a new financial transaction tax in recent months, but European economies outside the eurozone reiterated their opposition at a finance minister meeting in early November, 2011. The US also declined to give the proposed tax a firm backing at the summit of the world's 20 leading and developing economies in France.

Tensions between Germany and Britain over how to handle the crisis in the eurozone deepened after German chancellor Merkel was reported as not about to allow the UK to “get away” with its refusal to back a European financial transactions tax designed to curb derivative trading that causes instability in European financial markets. Merkel told the press: “Britain had a responsibility to make Europe a success.”

Volker Kauder, Chairman of the CDU/CSU parliamentary group in the Bundestag after a short term as Secretary General of the CDU, said at the CDU conference in Leipzig: “I can understand that the British don't want that [a transactions tax] when they generate almost 30% of their gross domestic product from financial-market business in the City of London. Only going after their own benefit and refusing to contribute is not the message we’re letting the British get away with.”

The transactions tax on has been proposed and discussed since the Asian Financial Crisis of 1997. The proposal receiving the most attention was the Tobin Tax, proposed by Nobel Laureate James Tobin in 1972 in his Janeway Lectures at Princeton, shortly after the Bretton Woods system of monetary management ended in 1971 with the dollar taken off by President Nixon from its linkage to gold, which created a situation whereby the US dollar as a fiat currency continuing to be the reserve currency for international trade, confirming the collapse of the Bretton Woods system of fixed exchange rates tied to a gold-back dollar.

Tobin claims that a currency transaction tax on all spot conversions of between currencies can act as a penalty to neutralize short-term financial round-trip excursions for profit from rapidly exchange rate fluctuations, and to stabilize foreign exchange markets.

The proposed tax is to be levied at each exchange of a currency into another at 0.5% of the volume of the transaction, to eliminate potential profit from currency speculation even as such transaction drastically increased interest rates for the currency under attack. Sharp increases in interest rates are disastrous for a national economy as shown in the financial crises in Mexico, East Asia and Russia in the late 1990s. The Tobin tax would return some margin of maneuver to issuing banks in small countries and would be a measure of opposition to the dictate of speculative forces the financial markets. Tobin tax has since been criticized as too mild to achieve the market stability that Tobin claimed

French President Nicholas Sarkozy expressed support for a “Robin hood Tax” to make the rich for their fair share of taxes which current loopholes tax laws permitted high income individuals to avoid paying taxes. The idea originates from the US in a populist swelling, supported by superrich individuals such as Warren Buffet and Bill Gates. But Britain’s Conservative government has resisted its implementation of any form of financial transaction tax unless all financial centers agree on the same tax, to prevent cross-border tax arbitrage.

.

Popular Discontent and Populist Politics

Vocal and violent mass demonstrations have been breaking out in the financially weak southern countries in the eurozone, particularly in Greece where the sovereign debt crisis is the most immediately critical. In the US where the Great Recession of 2008 is entering its third year, with unemployment expected to remain intolerably high for several more years, the Occupy Wall Street (OSW) protest movement of the victimized 99% of the population is picking up momentum and support beyond Wall Street and the US to many other countries around the world. The visible target is the financial sector known as Wall Street, but the real target is the structural unfairness of finance capitalism to the working class of the world. Popular discontent is ushering in a new age of populist politics.

A Debt Crisis Cannot Be Cured by More Debt

The European sovereign debt crisis, a financial disaster of excessive debt unsustainable by low wages, cannot be cured merely by financial bailouts from supranational institutions taking on more debt with sovereign guarantee to fund distressed sovereign debt, or by merely recapitalizing the distressed banking system with new money created ex nihilo (out of thin air) by expanded central bank balance sheets. The crisis has been caused by the dysfunctional monetary rules of finance capitalism and cannot be solved by rescue packages conceived under the same dysfunctional monetary rules merely to buy time until the same crisis explodes again at bigger scale.

The Need for an Income Policy

The fundamental long-term solution to the European sovereign debt crisis has to come from government commitment to a new income policy of rising wages to restore the balance between greatly expanded productive capacity from over investment and stagnant aggregate demand caused by low wages through global downward wage arbitrage.

Yet all the proposed rescue packages thus far are based on a dead-end strategy of pushing already low wages even lower through austere fiscal policy to pay off high levels of sovereign debt that had come into existence to mask imbalances created by decades of insufficient wage income for the average worker, the bulk of the population that the OWS protest movement identified as the 99% who are deprive of their fair share of the fruit of their labor by cross-border wage arbitrage that led to a debt-infested economy.

Fiscal Austerity that Pushes Down Wages Exacerbated the Debt Crisis

Fiscal austerity by governments of the poorer countries as demanded by the governments of the richer economies in the eurozone will only deepen the debt crisis rather than solving it. What the richer economies fails to understand is that their export to the common market within the eurozone will shrink unless all the economies in the zone have robust purchasing power through an income policy of decent wages.

The Need for a new Symbiotic Relationship between Capital and Labor

This sovereign debt crisis in Europe has morphed into a political crisis that will require a political solution to reconstitute a symbiotic relationship between capital and labor, away from the current exploitative relationship of capital over labor. Income disparity and wealth concentration are the causes of the debt crisis

Solution Cannot Come From One-Size-Fit-All Measures

The crisis has already claimed the fall of two coalition governments in the eurozone: Greece and Italy. It is not clear if the replacement governments can deal more effectively with the domestic socio-economic problems associated with rescue proposals hammered together by creditor governments in other capitals.

For more than two years, the overall economy of the eurozone, which is really a composite of national economies of very different shapes, characters, history and culture, has been incapacitated by a fatal malaise an externally imposed one-size-fit-all supranational monetary policy and standardized fiscal criteria on the separate domestic economies in different constituent nation states linked by a monetary union without a fiscal union. The disparity between different national economies of member states in the eurozone and in the European Union is wide and structural.

For example, national attitude toward inflation is diametrically opposite between Germans and Italians. The more advanced northern economies do not need, nor do they want the same expansionary monetary policy and fiscal permissiveness for optimum economic growth as the poorer economies of the southern countries. Yet these separate national economies are artificially linked to a common currency with a rigid unified monetary policy controlled by a supranational constitution that dictates rules of acceptable fiscal behavior for all eurozone member states.

The European sovereign debt crisis manifests itself in distinctly different problems that overlaps and exacerbate each other. The PIIGS (Portugal, Ireland, Italy, Greece and Spain) are facing crises of excessive debt, both sovereign and private debt, brought about by an abrupt and sharp decline in economic growth rates caused by catastrophic external monetary events from across the Atlantic. This contraction in the PIIGS economies transmits a crisis of liquidity, possibly even solvency, to threaten the banking system in the European Union, regulated and supervised by a supranational European Central Bank (ECB).

Leading the pack of deficits hawks, German Chancellor Angela Merkel unveiled plans in June 2010 for €80 billion ($107 billion) in budget cuts over the next four years -- a package she hoped would bring by 2013 Germany’s structural fiscal deficit within the European Union’s Stability and Growth Pact (SGP) limits of 3% of GDP. This tight fiscal policy in the midst of a sharp economic contraction caused by financial events in the US has the effect of dragging the entire eurozone into the abyss of debt deflation with an extended period of economic stagnation, not to mention social unrest and political instability. The economic impact of the proposed austerity program will neutralize the stimulus programs.

The European Union is a Dysfunctional Family of Unruly members

The cumbersome policy-making procedures and centrifugal political dynamics of the EU rival Byzantine politics in complexity, deviousness, and intrigue, depriving the union of strong effective political leadership. The EU as it is currently constituted is like a dysfunctional family with unruly independent members, making EU political leaders impotent to deal effectively with the on-coming crisis in a timely, decisive and effective manner before the problem became unmanageable. Behind every eurozone government declaration of unwavering commitment to the continuation of the economic union with the euro as its common currency, lays the fear of the commitment being overwhelmed by powerful centrifugal economic nationalism and political self-determination. Support for the euro is always qualified by reservation on the loss of independent monetary sovereignty.

This dysfunctionality has forced vocal supporters of the monetary union, such as German Chancellor Merkel, to call for a new treaty to enforce closer co-ordination of economic policy-making, moving expeditiously towards a fiscal union. Ironically, the concern for disparate fiscal policies among member states of the eurozone had pushed Merkel to veto a eurozone-wide guarantee for banks in the eurozone to replace the national responsibility for banks operating in each national economy.

Yet, the idea of a new treaty is not meaningful as a solution to a crisis that requires immediate solutions. The history of the European monetary union shows that treaties took years to negotiate and even more years for ratification by all the member states before entering into force. Besides, the Stability and Growth Pact (SGP), as set up in the Maastricht Treaty of 1992, already clearly defines monetary and fiscal criteria for eurozone member states. Still, it failed to keep member states from violating the clearly stated criteria of SGP.

The financial history of Germany leaves the current federal republic with a garrison state apprehension against inflation to prevent a recurrence of socio-economic instability that bred political extremism in the 1930s. To German political leaders, peace in Europe requires European integration. European monetary union is viewed by Germans as an effective transition toward eventual European political union, The monetary instrument for bring about Europe’s new regional socio-political order is the euro, a common currency designed to entice national behavioral convergence towards economic and political union.

The logic behind regional cohesion is that monetary and economic union in Europe would serve to bring about a high common standard of fiscal discipline set by the German model to move smoothly towards voluntary political integration through an economic structure in which what is good for the integrated constitution is also good for the constituents national units individually.

Full Cohesion of Europe is Wishful Thinking

The European sovereign debt crisis has exposed the principle of full cohesion as wishful thinking. The reality remains that supranationalism continues to be resisted by deep-rooted nationalist culture set by the Peace of Westphalia in 1648 even in the 21st century. There remains widespread suspicion that the common good in the eurozone is neither shared equitably nor paid proportionately by all constituent nations.

Deep-rooted Westphalian national cultural fixations continue to infest separate national perspectives and national behavior to block full cohesion of the eurozone and of Europe. The hope that a common currency would ensure collective financial stability and fiscal union for the eurozone has been shattered by deregulated market forces in the first externally sourced recession in the eurozone as a unit in the neoliberal globalized economic system since the introduction of the euro in 1999. In the current European sovereign debt crisis, the prerequisites of common monetary credibility are testing regional political cohesion in a confrontation between eurozone member states of uneven economic strength and fiscal discipline and most significantly socio-political culture.

The Debate on German Responsibility

Yet, in Germany, the strongest economy in the eurozone, the domestic political discourse on German responsibility for the monetary health of the eurozone is conditioned on German expectation of non-Germans in the eurozone to think, act and behave as Germans traditionally do, with a national government of fastidious fiscal discipline, and an socio-economic culture of domestic frugality and a competitive work ethic that yields persistent trade surplus, notwithstanding that within the euro trade zone, systemic equilibrium means that surplus in current account and capital account in some national economies can only come from deficit in current accounts and capital accounts of other profligate national economies.

It is simply not possible for every trading nation in a trading system to have a trade surplus. The win-win myth of neoliberal trade conflicts with the zero sum reality of the accounting game of national surplus and deficits. Regional integration removes the fear of invasive foreign financial and economic imperialism independent sovereign states rely on to maintain national discipline.

In a fully cohesive system, it is only equitable for fiscal deficits in the poorer units to be paid for by fiscal surplus in the richer units. In the US, New York and California consistently send more tax revenue to the federal government in Washington than these two rich states receive back in federal funding.

Fiscal Deficits are the Symptom, not the Cause of the Sovereign Debt Crisis

Further, it is not informative to blame the European sovereign debt crisis entirely on fiscal deficits incurred by some profligate national governments in the eurozone since these governments have voluntarily surrendered independent sovereign monetary policy authority to a supranational authority. Constituent governments of the eurozone are thus deprived of options of traditional monetary measures to defuse mounting sovereign debt problems with currency devaluation to restore balance of external trade. Fiscal deficit is the symptom, not the cause of the sovereign debt crisis. Solve the sovereign debt problem with economic growth will automatically eliminate the fiscal deficit. But arbitrarily cutting the fiscal deficit will only stifle economic growth to exacerbate the sovereign debt crisis.

The idea that some countries are in financial difficulty because of poor fiscal management by their governments is only a convenient cop-out. Several of the distressed national economies in the eurozone have public and private debt levels not much worse than those of the US.

The US Immune to Sovereign Debt Crisis Because of Dollar Hegemony

But the US does not need to go to the International Monetary Fund (IMF) for emergency loans because the Federal Reserve can provide the US economy with all the dollars it needs by monetary measures such as interest rate policy and quantitative easing by expansion of central bank balance sheet, while the Treasury can sell as much sovereign bonds as its needs, subject only to national debt limit set by Congress. This is because the US, by having all its debts denominated in its own fiat currency, has no foreign debts, only domestic debts held by foreigners. Dollar hegemony also gives the US exceptional privileges to run current account deficits perpetually. (Please see my April 11, 2002 AToL article on Dollar Hegemony)

This is fundamentally different from eurozone economies the sovereign debt of which is denominated in euro, a common currency over which each individual sovereign state in the eurozone does not enjoy sovereign monetary authority. This is of significant political importance because resentment against fiscal austerity needed to deal with sovereign debt problems is more acute when viewed by the public as being imposed by foreigners rather by self government.

Greek and German Attitude on IMF not Identical

Even for Greece, the most egregious sovereign debtor in the eurozone, the IMF would normally offer temporary liquidity support in return for currency devaluation with fiscal conditionalities. Even IMF has recognized that it severe conditionalities requirements for last resort lending has often been counterproductive.

The people of Greece have the choice of accepting IFM conditionalies which can be oppressive, or to withdraw from the world trading system temporarily. The IMF then acts as a bank of last resort, and while the Greek people may not feel grateful amity toward a supranational bank, the decision to seek help remains voluntary and the penalties are accepted the result of a voluntary decision by the borrowing nation.

With the proposed rescue terms of the supranational European Central Bank and its supranational affiliate such as the European Investment Bank (EIB) and the EFSF, the bailout special purpose vehicle of the EIB, the people of Greece understandable feel victimized by a supranational regime over which they have little control and from which they cannot withdraw honorably and equitably.

German Preference for a European Central Bank

On the other side, the German government rejects the idea that an outside body such as the IMF should dictate economic policy to a country that shares with Germany a common currency. Instead, Germany proposed a European Monetary Fund (EMF) to provide conditional temporary liquidity support to the European banks in debt crisis. Under the exclusive direction of member states of the eurozone, the EMF would set conditions on fiscal policy to the government requesting financial aid. In my July 12, 2002 AToL article, I proposed an Asian Monetary Fund (AMF) for similar reasons after the Asia financial crisis of 1997.

Lack of Transparency Makes Greek Sovereign Debt Impact Disproportionate to its Small Size

The turmoil over Greece’s public finances has shown Europe’s monetary union, which today has 16 member states, to be ill equipped to manage a sovereign debt crises denominated in euro. The debt problems of Greece, one of the eurozone’s smallest economies, with a GDP of €230 billion, has threatened the stability of the entire eurozone and the EU with a GDP of €12.3 trillion, the largest in the world, because the complex and opaque exposure to liability in special purpose vehicles leave unclear the amount of liability exposure for each and every sovereign market participant in a worst case eventuality.

Proposal for European Monetary Fund

Behind the rapidly mutating crisis, eurozone politicians have been considering the lessons of past crises in which the rapidity of financial market collapse was beyond the ability of slow process of organizing effective response. Establishing a European Monetary Fund is expected to help limit market uncertainty with prepackaged bailout procedures that are triggered by predetermined levels of crisis, acting as circuit breakers to prevent crises of market failure from spinning out of control.

The intention behind the EMF is to set up the rules and tools to prevent cumulative recurring market instability in the eurozone stemming from the indebtedness of even one single profligate member state government, such as Greece’s, or a group of unruly governments such as those of PIIGS nations. The first details of the plan, including support for an EMF modeled on the IMF, but more specifically designed for the more advanced economies of Europe, were revealed by German Finance Minister Wolfgang Schäuble.

The EMF fund would have resources to lend to eurozone member states in financial difficulty, but only subject to very strict conditions to curb excessive budget deficits and government borrowing. The idea was proposed by Germany and German officials are now trying to get France on board.

Few details on how the proposed European Monetary Fund will be organized and how it would work have been provided by the German Finance Ministry. Some semi-official ideas were developed in a working paper published in February 2010 by Daniel Gros, director of the Brussels-based Centre for European Policy Studies (CEPS), and Thomas Mayer, chief economist at Deutsche Bank.

Gros and Mayer argues in their paper in favor of a European Monetary Fund, saying that German leaders wanted to make sure that the Greek people understood what deep sacrifices would be necessary to get the country’s budget deficit under control. “They cannot get out of this without a very deep recession under the best of circumstances,” Mr. Gros told the press. “If they just start screaming when they see the dentist’s drill, they are lost.”

Events since have shown that the Greek people did much more than merely scream, with violent protests that declared if their leaders accept the austerity demands by EU leaders, they will really be lost.

The CEPS paper proposes funding the EMF out of levies on countries that incur debt above European Union rules on debt (60% of GDP) and fiscal deficit (3% of GDP) as spelled out in the SGP, thus increasing the incentive of undisciplined governments to comply. But this levy would also exacerbate the debt and deficit problems by taking money from those governments who need it most.

EMF funding would be supplemented by borrowing in the markets on the credit or guarantees of the European Union. The paper argues that if such a fund had been launched with the introduction of the euro in 1999, it would have accumulated €120 billion ($163billion) by now – enough to rescue a small-to-medium-sized eurozone member government from its sovereign debt difficulties.

It is an inconclusive argument since with the backing of the EMF, a member state will be able to accumulate higher levels of debt before triggering any reliable distress alarm signal. Much of the problem of the current debt crisis can be attributed to the use of special purpose vehicles by borrowing governments to secure funds from shadow banking financial institutions by hiding the excess debt from the balance sheets of government finance. Furthermore, unregulated structured finance would enable governments to leverage their reserve accounts in the EMF to take out more debt, defeating the function of such accounts as a raining-day reserve. The European sovereign debt crisis is not the outcome of not having safety rules; it was the result of purposeful violation of safety rules.

The CEPS paper spells out that in a crisis, a country could call on funds up to the amount it had paid in, providing its fiscal policies were approved by other eurozone members. Help beyond that amount would entail a supervised “adjustment program”.

When a government falls into imminent danger of default, the fund would have the power to issue replacement debt. But it would impose a so-called haircut on investors of the old debt who would receive only a fraction of the government bonds’ face value.

French officials appeared to be caught surprised by the speed of the EMF proposal from Germany. In principle, Paris backed proposals but is waiting for details on how it works. An unnamed spokesman said the proposed EMF “will help us avoid a repeat of the Greek situation.” But he emphasized that the plans were sketchy so far and the imitative is from Germany.

French economist and public policy expert, Université Paris-Dauphine Economics Professor Pisani-Ferry, Director of Bruegel, the Brussels-based economic think tank, said that though the approval hurdles are significant, the proposal was a positive development that the leading EU members were discussing ways to prevent future Greek-style meltdowns, adding that “It’s a sign they are learning from the crisis, which I think is good.”

Germany Wants Penalties for Fiscal Violations

German officials also want penalties to be imposed for fiscal violations. Among the proposed ideas are: suspension of European Union subsidies, the “cohesion funds”, to countries that fail to observe fiscal discipline; suspension of voting rights in ministerial meetings; and even suspension from the eurozone. A less controversial idea is to enforce fines already permitted under the EU’s Stability and Growth Pact (SGP).

Impetus for a European Monetary Fund initially came from the German finance minister, Wolfgang Schäuble, who told the German newspaper Welt am Sonntag in an interview that the countries that use the euro needed an institution with “similar powers to intervene” as the International Monetary Fund. Mr. Schäuble did not provide details of how the fund would work, saying he would present a plan soon.

The European Commission, the executive arm of the European Union, immediately endorsed the EMF proposal while officials in some European capitals complained that they had not been briefed on the plan. There was no explicit endorsement from German Chancellor Angela Merkel. The proposed EMF would represent a shift for known Germany position which resists providing financial assistance to countries that get in fiscal trouble because of bad policy decisions, even though those policy decisions were not considered “bad” by most risk analysts until after the global debt market crashed.

The problem was that creative structured finance of fiscal needs was deemed prudent by risk managers when marked to model in a normal market. Such structured finance only became risky when the normal market fails and normal hedges against risk lose their protective function. And the market failure was not caused by anything the governments of the eurozone member states did, but from the financial implosion of the burst of the global debt securitization bubble created in the US that caused a paradigm shift in the market that demolished the risk dynamics of all the structured finance models.

German Reservation on IMF

German leaders are known to feel that more in-group cooperation is preferable to accepting external intervention from the IMF. The use of IMF emergency funds has been held up as a bargaining chip to lower the cost of bailout from within the eurozone by George A. Papandreou, the Greek prime minister who had been forced to withdraw from government by the threat of a no confidence vote in parliament over domestic political criticism of his handling of the sovereign debt negotiations.

A move to bypass IMF involvement would also be sensitive for President Nicolas Sarkozy of France, as his most potent domestic political rival at the time, Dominique Strauss-Kahn, was then the head of the IMF, before falling from grace in a bizarre sexual scandal in a New York hotel owned and operated by a French hotel chain, in an episode of life imitating the movies.

German leaders also saw a European Monetary Fund as a vehicle to impose tougher sanctions on eurozone member countries that had defied with impunity SGP limits on fiscal deficit and national debt which all eurozone member states had voluntarily pledged to observe. Creative use of structured finance in sovereign debt securitization had allowed Greece to run up a real budget deficit equivalent to 12.7% of GDP — tripling the SGP limit of 3%, and a real national debt level of 120% of GDP, doubling the SGP limit of 60%, without triggering automatic SGP sanctions, provoking a sovereign debt crisis in triggering a sharp rise in interest rate on rollovers of its short-term sovereign debt that the Greek government had no money to meet.

A Greek default on its sovereign debt threatened to spread to Spain, Portugal, Italy and other eurozone countries, causing borrowing costs for their sovereign debt rollover to skyrocket. The fiscal crisis in Greece was not caused by excessively high wages and benefits of Greek public servants, as the German politicians assert; it was caused by a sudden and sharp rise of borrowing cost on its sovereign debt dispersed in a net of opaque structured finance instruments that in a normal market would have been quite manageable.

“Accepting help from the IMF would be an admission that the euro countries don’t have the strength to solve their own problems,” Mr. Schäuble told Welt am Sonntag.

Failed Campaign to Ban Credit default Swaps (CDS)

For a brief moment, European leaders put their fingers on a key cause of the sovereign debt crisis. French President Sarkozy called for a crack down on credit default swaps — a way for investors to hedge against the danger that a debt issuer will default. The swaps have been criticized because they allow speculators to in effect buy insurance on assets they do not own, destabilizing bond markets. Through a spokesman, German Chancellor endorsed the French campaign against structured finance.

(Please see my article on Credit Default Swaps (CDS) in the series: 2009 – The Year Monetarism Enters Bankruptcy:

Part I: Bankrupt Monetarism

Part II: Central Banking Practices Monetarism at the Expense of the Economy

Part III: Stress Tests for Banks which appeared in AToL on May 13, 2009 as Credulity Caught in Stress Test)

In Part III of the series, I wrote:

“CDS contracts are generally subject to mark-to-market accounting that introduces regular periodic income statements to show balance sheet volatility that would not be present in a regulated insurance contract. Further, the buyer of a CDS does not even need to own the underlying security or other form of credit exposure. In fact, the buyer does not even have to suffer an actual loss from the default event, only a virtual loss would suffice for collection of the insured notional amount. So, at 0.02 cents to a dollar (1 to 10,000 odd), speculators could place bets to collect astronomical payouts in billions with affordable losses. A $10, 000 bet on a CDS default could stand to win $100,000,000 within a year. That was exactly what many hedge funds did because they could recoup all their lost bets even if they only won once in 10,000 years.”

Almost a year later, on March 9, 2010, Greek Prime Minister Papandreou, encouraged by France and Germany, meeting with President Barack Obama in Washington, complained to the US president that Greece’s problems stemmed in part from a lack of transparency in the trading of complex financial instruments such as credit default swaps (CDS). “If we were to have transparency, I would say immediately we would have had much more possibility to prevent the crisis as it unfolded,” Papandreou told the press afterwards.

Papandreou argued that investor manipulation of CDS was pushing Greece to the brink of financial ruin and dragging down the euro. European officials then said they might ban some credit default swaps in European markets, while German Chancellor Angela Merkel called on Washington to help curb trading in the financial instruments.

In response, President Barack Obama said Europe should deal with its own debt problems, resisting pressure from Greek Prime Minister George Papandreou and other European leaders on the US to join a coordinated crackdown on market speculators, in keeping with the US own effort of financial regulatory reform since 2008. White House officials said Greece should focus on righting its economy and lowering its crushing sovereign debt, as if skyrocketed borrowing cost from credit rating downgrade had nothing to do with the Greek sovereign debt crisis.

Yet the sovereign debt crisis in Greece could be traced to a paradigm shift in the debt securitization market that began in the US. The White House’s cool response to Greece’s call for regulatory crackdown of CDS showed there was still no trans-Atlantic consensus on what - if anything - to do about the problem of destabilizing speculation in financial markets.

Some commentators questioned whether Germany’s proposal for a European Monetary Fund was designed to help Greece or to signal to Greek officials that they could not expect bailout aid from Europe soon and that Greece must solve its own problems by accepting austere fiscal reform.

The Futility of Beefing up the European Financial Stability Facility (EFSF)

The promise of more generous financial support from Germany and France for the sovereign debt crisis in Greece can buy time for the euro, but it is questionable if it can save the euro in the long run, not to mention the serious issue of moral hazard. The EU’s existing bailout special purpose vehicle, the European Financial Stability Facility (EFSF) own by the European Investment Bank (EIB), has €440 billion at its disposal. On September 29, 2011, the German parliament voted to give the fund expanded authority to raise more funds to enlarge its bailout purse to €1 trillion.

The EFSF is already providing liquidity support to Greece, Ireland and Portugal. It could, if necessary, give limited support to Spain but would have no spare financial capacity to help Italy which has sovereign debt at 120% of its $2.05 trillion GDP or $2.45 trillion outstanding.

In late October, 2011, a joint report by the EU and the International Monetary Fund (IMF) warned that, without a haircut by the creditor banks, the Greek sovereign debt crisis alone could swallow the entire €440 billion available to the EFSF, the bailout special purpose vehicle owned by the EIB – leaving nothing in spare to help the affected banks of Italy, Spain, France and Germany. The IMF added a condition of a 50% or higher haircut for the banks to IMF commitment to help Greece. The rescue deal finally agreed to has the banks taking a 60% haircut on the Greek debt they hold.

The Financial Cancer Spreads

As the European sovereign debt crisis dragged on like a growing financial cancer that metastasizes over the entire euro financial sector and the economy, eurozone government leaders played games with rescue proposals under the conventional rules of finance capitalism and at a scale that could only buy time to postpone a catastrophic collapse of financial markets in the eurozone. Yet similar to delays in treatment for cancer, time was actually working against the sovereign debt crisis to make the bailout more costly with each day of delay. Europe was playing for time when time was actually making the crisis more difficult to solve.

As Greece fell into the terminal stage of the debt cancer, financial markets started to doubt the availability of domestic political consensus and financial resources needed by EU political leaders to rescue Italy and Spain, two large economies with mountainous debt and insufficient economic growth under the current economic order and policy framework to sustain the rapidly escalating cost of servicing the debt which the market began to view as heading nearer to default. The cost of borrowing for these two debtor governments has risen sharply in both the primary and secondary debt markets, further exacerbating market skepticism in the ability of the debtor governments to meet even the increased interest payments due at the end of each passing month, let alone the prospect of ever paying off the debt.

German Refusal to be the White Knight to Save the Euro

To calm market volatility and to bring down borrowing costs for sovereign debt with credit rating downgrades, Germany needs to commit firm and timely support for a credible bailout plan designed to bring quick recovery toward growth to the distressed eurozone economies. But the financial options are limited and none are politically appealing. Without a strategy of boosting high growth, all the temporary life-support rescue deals only make the final collapse more painful.

Following US example, the European Central Bank (ECB) toyed with the strategy of stepping up purchases of eurozone distressed government bonds through central bank quantitative easing, to shift the distressed debt onto the balance sheet of the ECB and to interject desperately needed liquidity into the critically impaired eurozone financial system. But while the ECB is already buying small amounts of some southern European government bonds, the practice is of questionable legality. Further, Germany is not enthusiastic about further ECB quantitative easing, certainly not at a scale that would be helpful to the eurozone sovereign debt crisis.

The idea of introducing “Eurobonds” with collective eurozone government guarantee has been proposed, with eurozone member state governments raising money collectively as a single unit to ease the rising cost of separate borrowing for those member states with rapidly declining credit ratings. But the idea failed to attract much support, particularly from Germany, the strongest and highest rated economy in the eurozone, except as a post crisis long-term consideration, and only after fiscal discipline is solidly guaranteed by the governments of the southern economies. There is logic in the Germany resistance as its may encourage the southern member states to exploit the good credit ratings of the strong northern economies to delay necessary fiscal reform in their own economies.

This leaves the option of strengthening of resources of the EFSF, a special purpose vehicle of the European Investment Bank (EIB), possibly through credit mechanisms that would link it to the ECB, as the only feasible solution as an immediate measure. A bailout purse of €2 trillion was discussed in July, 2011. By the time the plan to boost the financial power of the EFSF was adopted by all member states at the end of September, after a precarious political struggle by Chancellor Merkel in the German parliament, the amount needed had gone up to €6 trillion.

The Centre for European Policy Studies, a think tank in Brussels, calculated that as a bank instead of just a special purpose vehicle owned by the EIB, the EFSF could lend up to ten times its capital even in this difficult market, which would mean the €440 billion of capital in the facility could in theory be transformable into more than €4 trillion of bailout funds.

Bailing Out a Debt Crisis with More Debt

But bailing out distressed debt with more debt is an addict’s folly, not a viable solution in finance. The European sovereign debt crisis and the dysfunctionality of the euro as a common currency without a common fiscal union is a fundamentally inoperative arrangement.

To cure the sovereign debt malaise under crisis conditions, much of the sovereign debt owed by Greece, Portugal and even Italy will have to be written down if not written off entirely, and the debt must be extinguished, rather than merely shifted into a gigantic supranational special purpose vehicle from many mini national special purpose vehicles facing imminent default. The huge amount of distressed European sovereign debt with rising interest payments will exacerbate fiscal deficits for the national issuers, causing the cost of new borrowing to skyrocket in a vicious debt circle. But debt write-off will in turn require a massive recapitalization of European banks. The amount of capital needed ranges from by €200-300 billion as estimated by the IMF, to €6 trillion by some conservative market analysts.

Fiscal Austerity Counterproductive

Many neoliberal economists have suggested that the heavily-indebted governments in the eurozone need to adopt austere fiscal policies to keep government spending under control to keep it in line with projected revenue, and to introduce structural economic reforms that will facilitate economic growth through national competitiveness in cross-border trade. Fiscal austerity can help only as a gradual long-term cure. As a measure in the midst of a financial/economic crisis, fiscal austerity is equivalent to pouring oil on fire, both economically and politically

Trade Competitiveness a False Cure

But the entire world cannot expect to pay off sovereign debt with current account surplus from export to other economies. Within the eurozone, the trade surplus for one member state must be a deficit for a counterparty member state in intra-zone trade. Thus within the eurozone, trade competitiveness cannot be a solution to a systemic sovereign debt problem. If trade competitiveness is achieved by lowering domestic wages, it would in fact exacerbate the debt crisis further by further reducing aggregate demand as capital seeking higher return must push wages down with cross-border wage arbitrage.

A case in point is Greece. Similar to Portugal, Italy, Ireland and Spain, Greece suffers from low labor productivity and low wages, economic practices restrictive of competition, low-tech industry and a persistent state fiscal deficit financed by growing foreign loans denominated in the euro, a common currency over which national governments in the eurozone have voluntarily surrendered monetary policy authority to the supranational European Central Bank.

Greece Cannot Push Already Low-Wages Lower

Greece’s unit labor costs have diverged from those in Germany for doing the same work by around 30-40% since the launch of the euro as a common accounting currency on January 1, 1999. In order to restore cross-border trade competitiveness, Greece would have to cut already low wages by 50% from present levels. Not only will that lead to unacceptable levels of social and political instability, it actually will further reduce aggregate demand in the Greek national economy and force it to seek trade surplus from more export to a eurozone market in which every other constituent national government is also trying to pay for its fiscal deficit with a trade surplus earned with low-wage competitiveness. It is a “beggar thy own workers” game of no winners, just more destructive than its opposite strategy of “beggar thy neighbors” through protective trade tariffs.

Law of One Price Needs to Also Apply to Wages

While the law of one price applies to the value of the common currency within the eurozone, wages are not subject to the law of one price in the eurozone. As a result, fiscal union cannot be introduced along with currency union because the only way the low-wage southern economies in the eurozone can match the high living standard of the high-wage northern economies is to take on rising national debt. While the laws of capitalistic public finance can be adjusted to compensate for national socio-economic differences, they cannot be ignored totally. There-in lays the conceptual weakness of the idea of European integration via a common currency.

Export Trade –Dancing After the Music Has Stopped

Export trade is now a game in which the music, namely profitability in cross-border trade, has stopped while the players had no choice but keep doing the export dance. Looking to earn trade surplus through low domestic wages to pay for fiscal deficit necessary to compensate for low domestic wages is equivalent to a family renting out its children at slave wages to work for money to buy imported food at high cost, instead of the family growing its own food to feed all its members.

Greece Already in Default

Under current public finance accounting rules, Greece will officially default on its sovereign debt eventually. It is only a matter of time even if some form of bailout can be organized for Greece before the Greek government runs of out money. But the expected size of any realistically available bailout will not be sufficient to service and extinguish the amount of Greek debt outstanding. Default is postponed only by taking on more debt, a process that is unsustainable. Greece is already in technical default through haircuts negotiated and accepted by its creditors and rescuers. After the haircut, any creditor willing to extend more credit to Greece needs to have his head examined.

Bailouts Designed to Buy Time When Time Makes the Solution More Difficult

All the proposals to bailout Greece from its sovereign debt crisis so far can only postpone the final day of reckoning. And at the end of the day, Greece may realize that the best option is to abandon the euro and withdraw from the EU and accept the consequences of default. Staying in the eurozone would mean year after year of unremitting austerity for generations, an economic scenario looking worse by the week than a one-off sovereign debt default.

Leaving the euro and the eurozone, though financially traumatic in the near-term, would allow the debtor government to devalue a new national currency managed by a new national bank system that can adopt a monetary policy to support domestic development as the best prospect for domestic growth from a new base. Greece needs to abandon central banking which manages a supranational one-size-fits-all monetary policy to support the value of the euro as a common currency of the eurozone at the expense of the constituent economies by holding down demand. Instead, Greece needs to adopt national banking with a sovereign monetary policy that supports the monetary and financial needs of Greek economic development, and let the market set the exchange value of the new Greek national currency.

No comments:

Post a Comment